Risk-Return-Management for Non-Finance-Businesses

Value Based Risk Reporting and Management Control of Business Units

Vortrag an der 2. Jahreskonferenz Accounting and Finance 2011 (AF 2011) in Singapur.

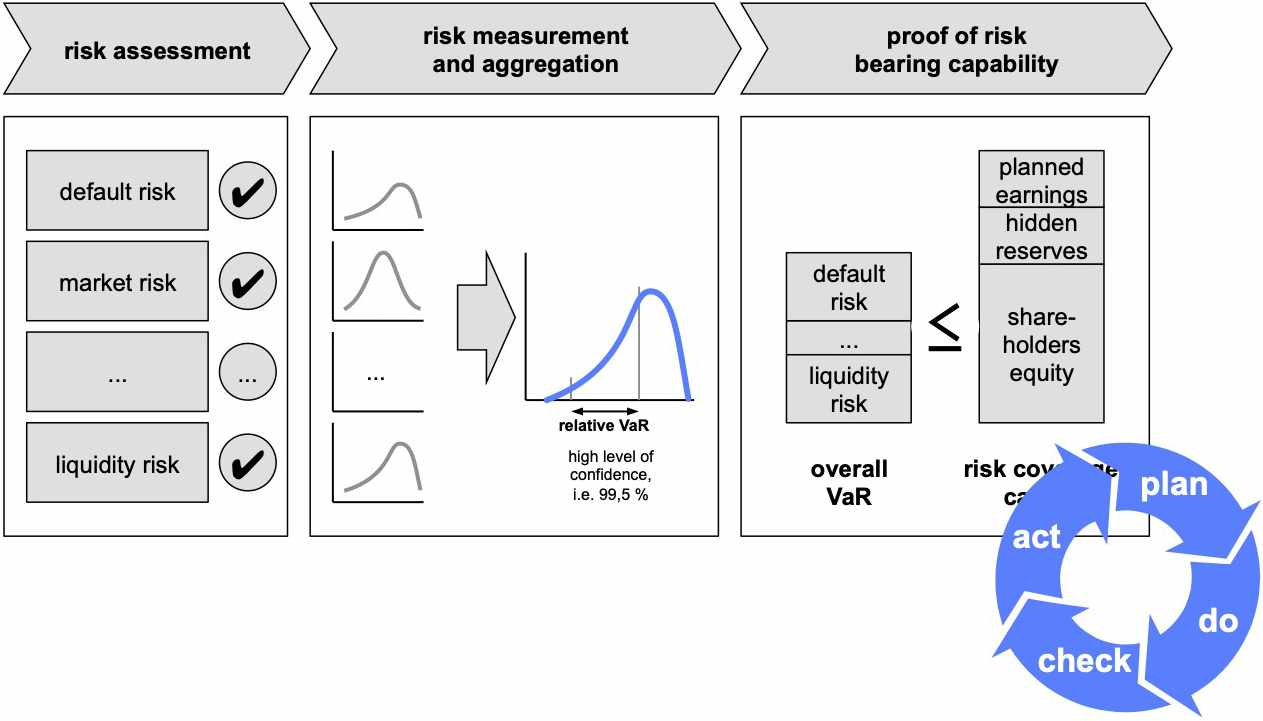

Risk Management and Value Management are each extensively represented in literature. However, approaches dealing with their interconnections and concerning non-financial business units are scarce. For example, the allocation of risk limits to business units is mainly discussed in the banking or insurance sector in respect of financial risk measures such as the Value at Risk of assets. On the other hand, value based key figures such as EVA, CFA or CFROI, which are widespread in the industrial sector, are risk adjusted only on a highly aggregated level, e.g. by WACC on the enterprise or unit level. Therefore, this paper proposes a new approach based on downside risk measures for the allocation of risk limits to non-financial business units in regard to value-based management and for the risk reorting of value based, risk adjusted key figures.